Understanding Technical Analysis: Popular Tools and Strategies for Forex Trading

Technical and fundamental analysis are two widely used methods of analyzing the foreign exchange market. Both approaches have their own advantages and disadvantages, and traders should consider which method best suits their trading style and goals. In this article, we will discuss the right technical and fundamental analysis tools for forex trading, and how to use them to make informed trading decisions.

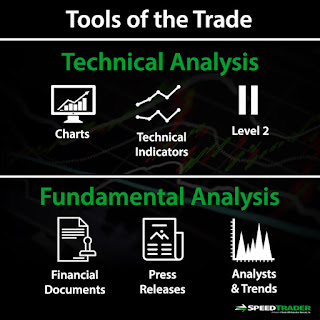

Technical Analysis Tools:

Technical analysis is the study of past market data, primarily price and volume, to identify patterns and make trading decisions. Technical analysis tools include charting software, indicators, and oscillators. Some of the most popular technical analysis tools include:

- Moving averages: These are trend indicators that help traders identify the direction of the market.

- Bollinger bands: These are volatility indicators that help traders identify overbought and oversold conditions.

- Relative Strength Index (RSI): This is a momentum indicator that helps traders identify potential trend reversals.

- Fibonacci retracement: This is a technical analysis tool that uses horizontal lines to indicate levels of support and resistance.

Fundamental Analysis Tools:

Fundamental analysis is the study of economic and political factors that can affect the value of a currency. Fundamental analysis tools include economic indicators and news releases. Some of the most important fundamental analysis tools include:

- Gross domestic product (GDP): This is a measure of the economic activity in a country.

- Interest rates: These are the rates at which banks lend money to each other, and they can have a significant impact on currency values.

- Inflation: This is the rate at which the overall price level of goods and services is rising.

- Political events: Political events such as elections and policy changes can also have a significant impact on currency values.

Using Technical and Fundamental Analysis Together:

Both technical and fundamental analysis have their own strengths and weaknesses, and many traders find that using both methods together can provide a more complete and accurate picture of the market. For example, a trader may use technical analysis to identify a potential trade, and then use fundamental analysis to confirm the trade.

Conclusion:

In conclusion, technical and fundamental analysis are two widely used methods of analyzing the foreign exchange market, both have their own advantages and disadvantages. Choosing the right technical and fundamental analysis tools depends on the trader's goals and style. By using both methods together, traders can gain a more complete and accurate picture of the market and make informed trading decisions. It's also important to regularly review the performance of these tools and make adjustments as needed.

Comments

Post a Comment