What are Spreads and Fees?

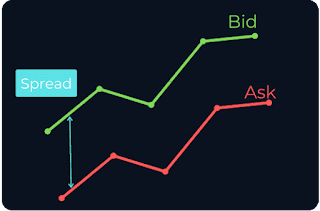

In the forex market, the spread is the difference between the bid and ask prices for a currency pair. When you place a trade, you will typically be required to pay the spread as a cost of the trade. For example, if the bid price for EUR/USD is 1.2050 and the ask price is 1.2055, the spread would be 5 pips (0.0005).

In addition to spreads, brokers may also charge other fees such as commissions or financing charges. These fees can vary widely from one broker to another, so it is important to compare the costs of different brokers in order to find the most competitive options.

How to Compare Spreads and Fees.

There are a few key things to consider when comparing the spreads and fees of different brokers. First, consider the type of account that you will be trading with. Some brokers offer different spreads and fees for different account types, such as standard accounts, premium accounts, or VIP accounts.

Next, consider the currency pairs that you will be trading. Some brokers may offer more competitive spreads for certain pairs, while others may have higher spreads or fees for certain pairs. It is important to compare the costs of the pairs that you are most interested in trading.

Finally, consider any additional features or services that the broker offers. Some brokers may offer additional resources or tools that can help to offset the cost of higher spreads or fees. For example, a broker with a strong selection of educational materials or market research may be worth considering even if their spreads are slightly higher than those of other brokers.

Summary:

When trading forex, spreads and fees can have a significant impact on your profitability. It is important to find a broker that offers competitive costs in order to minimize your trading expenses. By considering the type of account, the currency pairs you will be trading, and any additional features or services offered by the broker, you can find the most cost-effective options for your trading needs.

Comments

Post a Comment