Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange market. The goal of forex trading is to profit from changes in the value of one currency against another. However, as with any investment, there is always the risk of loss. One of the most important tools for managing risk and maximizing profits in forex trading is the risk-reward ratio.

In this guide, we will discuss what a risk-reward ratio is, how it works, and how to use it effectively in your forex trading strategy.

What is a Risk-Reward Ratio.

A risk-reward ratio compares the potential loss on a trade to the potential profit. A common risk-reward ratio is 1:2, which means that for every dollar risked, the potential profit is two dollars. This ratio can be adjusted based on the trader's risk tolerance and their overall trading strategy.

Why is Risk-Reward Ratio Important.

Risk-reward ratio is important because it helps traders to manage their risk and make informed trading decisions. By understanding the potential loss and potential profit for a trade, traders can better determine if the trade is worth the risk. For example, if a trader sets a stop loss at a certain percentage or dollar amount below the market price, and the potential loss on the trade is $100, the trader should aim for a potential profit of at least $200. This means that the trader should set their take profit level at a point where they would achieve a 1:2 risk-reward ratio.

By using a risk-reward ratio, traders can also ensure that their overall trading strategy is profitable in the long run, even if they have a string of losing trades. This is because the potential profit on winning trades will be greater than the potential loss on losing trades.

How to use Risk-Reward Ratio Effectively.

- Use a risk-reward ratio when setting the stop loss and take profit levels.

- Keep monitoring the trade and adjust the stop loss and take profit accordingly.

- Use it in conjunction with other tools such as technical analysis and market analysis to make informed trading decisions.

- Set the risk-reward ratio according to your risk tolerance and overall trading strategy.

It's also important to keep in mind that the volatility of the currency pair you're trading will play a significant role in determining the appropriate risk-reward ratio. For example, if you're trading a currency pair with high volatility, you may want to use a smaller risk-reward ratio to protect your profits, while if you're trading a currency pair with low volatility, you may want to use a larger risk-reward ratio to maximize your potential profits.

Another important aspect to consider when using risk-reward ratio is the time frame of your trade. If you're a short-term trader, you may want to use a tighter risk-reward ratio to quickly capture small market movements, while if you're a long-term trader, you may want to use a wider risk-reward ratio to capture larger market movements over a longer period of time.

In conclusion, risk-reward ratio is a powerful tool for managing risk and maximizing profits in forex trading. By understanding how it works, and using it effectively, traders can better manage their risk, protect their profits, and increase their chances of success in the forex market. Remember to always keep monitoring the trade and adjust the stop loss and take profit accordingly and use it in conjunction with other tools such as technical analysis and market analysis to make informed trading decisions.

Summary

Risk-reward ratio is a vital tool for managing risk and maximizing profits in forex trading. It allows traders to compare the potential loss on a trade to the potential profit, and adjust their strategy accordingly. By understanding how to use risk-reward ratio, traders can better manage their risk, protect their profits, and increase their chances of success in the forex market. It's also important to keep in mind that the volatility of the currency pair you're trading will play a significant role in determining the appropriate risk-reward ratio. Additionally, it's important to use it in conjunction with other tools such as technical analysis and market analysis to make informed trading decisions.

we should to use 1:2 risk-reward ratio?

The 1:2 risk-reward ratio is a commonly used ratio in trading and is considered a good starting point for many traders. It means that for every $1 at risk, the potential profit is $2. This ratio allows traders to make back their losses and earn a profit even if they are right only 50% of the time. This ratio is considered to be conservative and it is a good way to manage your risk, however, it's not a rule and different traders might have different preferences and risk tolerance, so it's always important to evaluate what works best for you.

However, it's important to note that the risk-reward ratio is not the only factor to consider when evaluating a trade. Other factors such as the overall market conditions and the specific characteristics of the currency pair you are trading should also be taken into account. Additionally, there is no one size fits all solution, it's important to evaluate the trade based on its own characteristics.

It's important to remember that the risk-reward ratio is a guide and not a rule, and it's always important to use it in conjunction with other tools such as technical analysis and market analysis to make informed trading decisions.

Which strategy has the highest risk-reward ratio?

The strategy that has the highest risk-reward ratio is subjective and can vary depending on the trader's risk tolerance and overall trading strategy. However, some strategies known for having a high risk-reward ratio include:

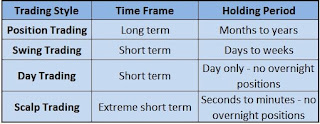

- Position trading: This strategy involves holding a position for an extended period of time, typically weeks or months. Because the holding period is longer, the potential profit is also higher, but the risk is also greater as the market can move against the trader for an extended period.

- Swing trading: This strategy involves holding a position for a few days to a few weeks. It allows the trader to capture intermediate-term trends in the market, and the potential profit is higher than day trading, but the risk is also greater.

- Scalping: This strategy involves taking advantage of small price movements by making a high number of trades in a short period of time. The potential profit is lower than other strategies, but the risk is also lower as the trader is only in the market for a short period of time.

- Options trading: This strategy allows traders to profit from market movements by buying or selling options contracts. The potential profit is higher than other strategies, but the risk is also greater as options trading is considered more complex and volatile than other strategies.

It's important to note that these strategies all have their own unique characteristics and risk-reward ratios, and no strategy is guaranteed to be more profitable than another, as it depends on the market conditions and the trader's

Comments

Post a Comment